by Myles Ma March 7th, 2018

Richard L. Spix's brother died in 2015. He crashed his motorcycle into a car and was killed instantly. He had no wife, no children and no will.

That was difficult enough, but as the Spix family would learn, only the beginning of the troubles caused by the lack of an estate plan.

Under California law, and most state laws, his estate passed to his parents. Richard had to go through the probate process to deal with his brother's assets, which in California requires a lawyer. His brother, who was in his 30s, had made very few end-of-life plans.

He had life insurance through his job for the Los Angeles County government, worth less than $100,000, and a retirement account. He had some savings, a house in Diamond Bar, California, worth nearly $400,000, furniture and a gun.

His life insurance policies had designated beneficiaries, but Richard didn't know who they were. So he had to call his brother's ex-wives and girlfriends to find out who could claim the money from the three insurance policies. Eventually they paid out.

California law generally requires every gun transaction to go through a licensed dealer and a 10-day waiting period. Richard's father had to fill out a form with the state department of justice and find a licensed broker to sell the 9-millimeter pistol for $400.

Richard had the emotionally difficult job of picking up his brother's wrecked motorcycle from an impound yard to repair it and sell it. Then there was the house, where his brother's fiancee had lived for two years. The family agreed to pay her $50,000 to move out; half up front and half when they received the keys.

"I didn't want to kick an almost-widow out in the street," Richard said.

Then Richard's mother died at the end of 2015. His parents had a three-inch binder of trust documents they updated each year.

"They had done everything right," he said.

But Richard's mother died before his brother's assets were distributed to his parents. Half of his brother's estate went smoothly to his father, but the family had to file another probate case for his mother's share of his brother's estate.

Richard's father died three years later. He spent the last year living with Richard's family. When his father died, all Richard had to do was file two tax returns for his parents' trusts, a matter of a few mouse clicks.

"It was so freaking easy I couldn't believe it after pulling teeth for a couple of years," he said.

It drove home how much easier dealing with his brother's estate could have been if he'd had a will.

Why don't people make an end-of-life plan?

Richard's brother was in his 30s. Many people don't think about estate planning until later in life, said Lori Anne Douglass, a partner with the Douglass, Rademacher & Brown law firm in New York. But it's better to plan early, she said.

"You should really start your estate planning as soon as you own assets, as soon as you have a first job, as soon as you have a child," Douglass said.

While people might be tempted to put off planning until they're in their 50s, they could die before that, Douglass said.

Matt, a Tennessee resident (he declined to give his last name to protect his family's privacy), said culture plays a role too.

"We're from the rural South," he said. "Everyone still operates on the 'good ol' boy' system where they think a handshake is enough."

That helps explain why Matt's retirement-aged father-in-law (let's call him Joe) died in fall 2017 without a will. Joe's second wife had paid off the mortgage on their house, but never got her name on the title. Without a will, Joe's son from his first marriage and his second wife now have to sort out who gets the house.

"Now there's this nightmare of trying to get the son to sign over the rights to the house because [my's mother-in-law] has the vast majority of equity in it," Matt said.

The family is hoping to avoid having to hire estate lawyers to settle the impasse.

How much can not having a plan cost your family?

Richard L. Spix's family paid more than $10,000 to an attorney to settle his brother's estate. When his mother died before it was distributed, it cost another $6,000 to bring the case to probate court. Those prices come even though Richard, who is a lawyer, though not an estate lawyer, got a discount from a friend.

Dying without a plan makes handling an estate much longer and more expensive, Douglass said. Probate court, where the distribution of a dead person's assets is handled, is always more costly when there's no plan. For example, when there's no designated executor, the court has to name someone, usually a family member, to administer the estate. Without a will, it's much more likely the court will require that person to put down a bond to make sure they're trustworthy.

Without a plan, state law dictates what happens to your stuff. That means people who would otherwise have little to do with each other could end up sharing assets, as was the case with Matt's mother-in-law. Because of that, assets like real estate have to be sold, which can be an ordeal in itself, Douglass said.

Douglass once worked on the estate of a man in his 30s who died after having a heart attack while playing basketball. His estate passed to his divorced parents, who did not get along, but had to work together to split the estate.

"There are so many unintended consequences and burden on the loved ones when there's no plan," Douglass said.

Let's say your relatives receive Medicaid or some other form of government assistance. Unless they receive an inheritance through a specific type of trust, they could lose those benefits if the windfall puts them above government income limits, Douglass said.

Making sure the kids are alright

Planning is even more important for people who have kids. You have to appoint a guardian not only to raise them, but also to take care of their inheritance — a minor legally can't inherit anything. Douglass has seen cases of poorly chosen guardians making off with kids' inheritances.

"When people die without an estate plan, you can really watch the destruction of families," Douglass said. "There's so much anger, there's so much resentment, there's stress."

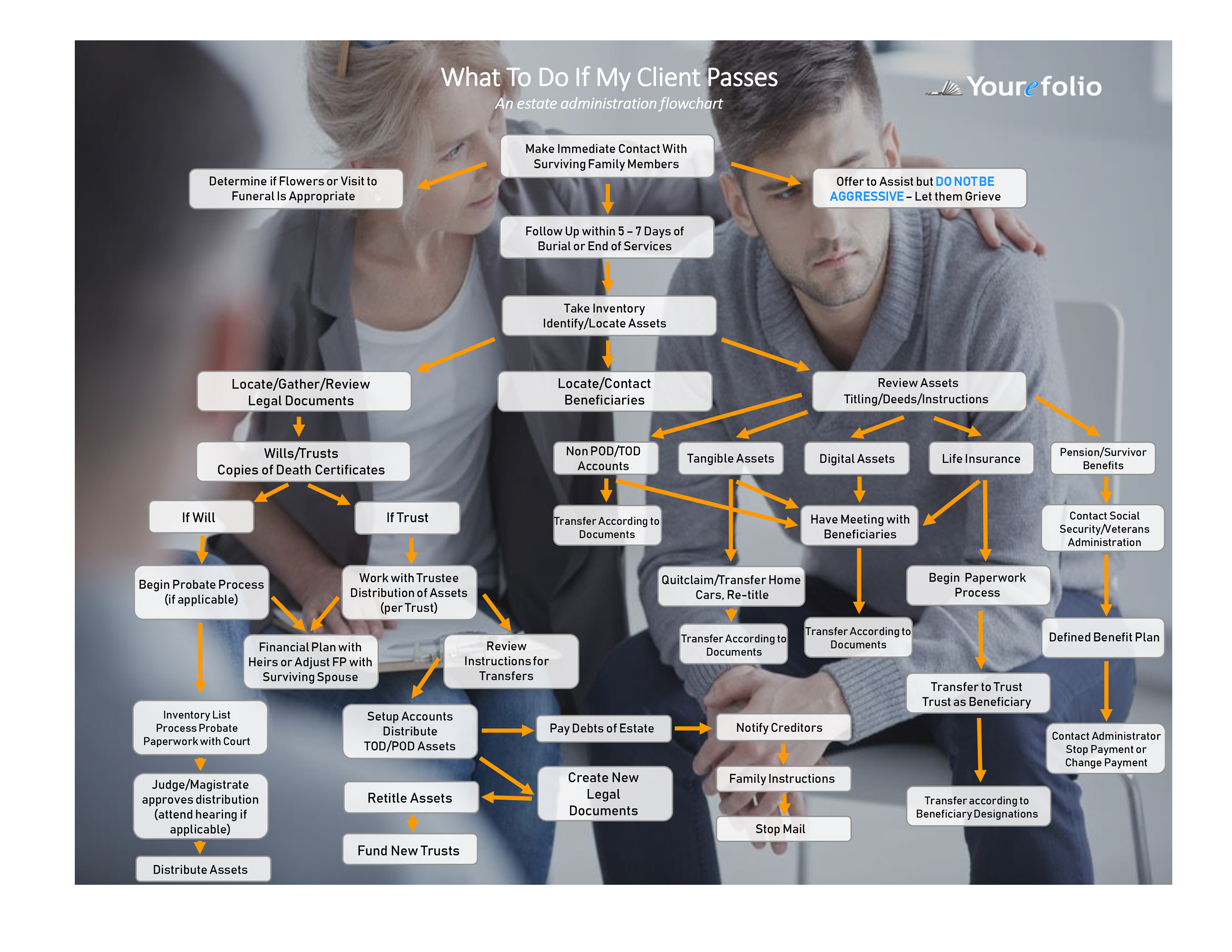

Family drama is one of the biggest problems caused by a lack of planning, said Scott Huff, CEO of Yourefolio, an estate planning software company. Even if families agree on how to divide assets, without a plan that includes accurate appraisals of your possessions, they may sell them for less than they're worth.

What about debt?

The good news is family members aren't responsible for any debt left behind after death, unless they've co-signed on that debt or live in a community property state where spouses are responsible for debt incurred during the marriage.

But it's a common misconception that the debt disappears when someone dies, Douglass said.

"That's not true. It has to come out of the estate assets," she said.

State and federal taxes get the first bit of the estate, followed by debt, administration costs and the funeral before any assets fall to the heirs.

"You'll certainly lose [part of the] inheritance after having to pay the debt," Huff said.

End-of-life planning can help people get a handle on how much they owe and focus on paying it off before they die. Additionally, life insurance can provide the cash to help pay off debts after death, Douglass said. Taking stock of your debt is one step to figuring out how much life insurance you need.

Dealing with debt collectors

While family members aren't responsible for paying the debts themselves, creditors may try to come after them anyway. Debt collectors can call a deceased person's spouse, parents (if the deceased was a minor), guardian, executor or administrator to get contact information for the person authorized to pay the deceased's debts. But they can't demand those parties pay and have to follow the rules set by the Fair Debt Collection Practices Act.

For instance, contact is limited and, if you want the calls to stop, you can tell them in writing you don't owe any money. The Federal Trade Commission has more details on what a debt collector can and can't do following a debtee's death.

There is one case where a debt collector has a right to contact you regarding a loan the deceased was paying off: When they cosign a loan, as many parents do for their children's student loans.

"If you cosign for a home, a car, anything like that, they're going to go after the cosigner," said Gene Newman, editorial director for Everplans, which provides digital tools for estate planning.

How do you start estate planning?

A good place to start is creating an inventory of your stuff, which you may have already done for your renters or homeowners insurance, Huff said. Make sure your beneficiary designations for your retirement accounts and insurance are up-to-date.

Almost everyone has assets that need to be administered when they die, Douglass said.

Life insurance is also a good idea, she added, especially early on. It's harder and more expensive to get life insurance later in life.

You can find forms for a health care proxy, living will and power of attorney online. These help decide what happens if you become too disabled to make medical decisions for yourself.

You will likely need an estate lawyer to help make a plan, Douglass said. The expense of hiring one can vary depending on where you live, your assets and how extensive you want your plan to be.

Matt, from Tennessee, and his wife hired an estate planner soon after he graduated dental school to avoid conflicts like the one in his mother-in-law is experiencing.

"I guess people don't think just having a house and a couple of vehicles is a big deal, but as we've found out, that's enough," he said.

Richard L. Spix, the California lawyer, remembers his father carrying a suitcase filled with stacks of documents while dealing with his brother's death. Spix doesn't want to leave the same for his family.

"That is not what you want to do to somebody if you really like them," he said.

Richard has a trust to take care of his children when he dies, but that's only half the work. He makes sure to update it every time he opens a new account. It's part of accepting that he is mortal, as we all must do.

"You really should outgrow that teenager indestructible mentality if you're going to pretend to be an adult," he said.