With the percentage of elderly people in the United States on the rise, someday soon you may face situations like these:

- * A longtime client calls you in a panic. His mother has suffered a fall, and her doctor says she shouldn't live by herself any more. Your client hasn't given any thought to where his mom would live should she require long-term care, and he has no idea how she'll pay for it. She leaves the hospital tomorrow, and he and his family have been anxiously calling one another all weekend trying to figure out what to do.

- * Rose used to be the ideal client. She always turned in her paperwork complete and on time and never missed an appointment. But this past year, you've noticed that she's been less conscientious. She's forgotten to make a couple of payments, and her mind seems to wander during meetings. You had to call her twice to complete her tax returns because she gave you so much incorrect information. Should you let her, or her family, know you're concerned?

Though CPAs tend to regard elder planning as a niche area, soon many of them will need to at least be conversant with elder care issues. One in seven Americans was over 65 in 2015, and the number of senior citizens continues to grow. By 2030, the U.S. Census Bureau predicts, more than 20% of the U.S. population will be over 65.

"In the next 15 years, another 40 million Baby Boomers are going to retire," said Ted Sarenski, CPA/PFS, the CEO and president of wealth management organization Blue Ocean Strategic Capital in Syracuse, N.Y. "So there's a tremendous need for elder planning advice." Older clients and their families need guidance on areas such as finding and paying for long-term care, financing health care, and ensuring their estate planning documents are up to date. They may also face sudden crises that require major financial decisions to be made quickly.

-

When problems like these arise, clients often turn to the CPAs they know and trust. And CPAs—even those who aren't financial planners—are better-equipped to help them than they might realize.

At the very least, advisers can know where to send a client for more help. They can build up a network of trusted financial planners, elder law attorneys, aging life care professionals (formerly called geriatric care managers), and other local professionals to whom they can refer clients.

-

Most CPAs won't need to think of elder planning "as a separate line of business that they're going to spend huge amounts of time on," said Lyle K. Benson, CPA/PFS, president and founder of Baltimore-area CPA and financial planning firm L.K. Benson & Co. "But I think they need to think about their client relationships and how they're going to need to provide resources and be a source of information for clients as they age, to deepen those relationships, and also to bridge the relationship to the next generation."

OTHER ELDER PLANNING SERVICES YOU CAN PROVIDE

But beyond referrals and providing information, CPAs can provide more services that can be of great help to older clients—and that would be relatively simple for firms to implement.

CPAs already have much of the financial knowledge they need to provide such services, said Martin Shenkman, CPA/PFS, J.D., a New York City-based estate planning attorney and law firm owner. "If you can complete a 1040 and handle bookkeeping and bill paying, you can do many of these things," he said. Advisers, he said, "don't realize that most people don't have the knowledge that they have. Just taking that knowledge and marshaling it to help the aging client would be a big help."

Some ways you can do so include the following:

Bookkeeping and bill paying

Bookkeeping and bill-paying services may sound basic, but they can be invaluable to certain older clients. Sometimes, older people have difficulty keeping up with their checkbook and paying their bills, which can put them at risk for a host of problems. They might miss important deadlines and incur fees and penalties. If they become incapacitated with their finances in disarray, their families may have a hard time determining what their income and expenses are.

CPAs can give many older clients and their families peace of mind by handling their books and payments for them, or by hiring or subcontracting a dedicated bookkeeper.

Shenkman advised CPAs to check their malpractice insurance to see what it covers before offering new services. Sarenski noted that a CPA will want to be insured and bonded before assuming check-writing privileges.

One advantage of managing your older clients' bookkeeping and bills is that you can keep an eye out for potential fraud or financial abuse. Shenkman, for instance, noticed that a company was fraudulently charging one of his older clients for a new air conditioner four times a year. His law firm was then able to contact the company and resolve the situation.

"Part of the reason I'm so passionate about elder planning is that I see so much elder financial abuse," Shenkman said. "I see so many elderly people struggle, and, with a handful of exceptions, none of their accountants has suggested that they can help. But they can."

Basic estate planning

Death and chronic illness are uncomfortable topics. Many clients are hesitant to talk to their advisers and families about what could happen should they suddenly die, become seriously ill, or develop dementia. But when families fail to discuss these issues, they can be left scrambling when a crisis does occur. If an older person becomes incapacitated without a will or a health care power of attorney in place, for example, family members can clash over what choices to make on their behalf.

CPAs can gently encourage clients to develop a plan for what should happen in the event of an emergency or health crisis, and to discuss it with their family members.

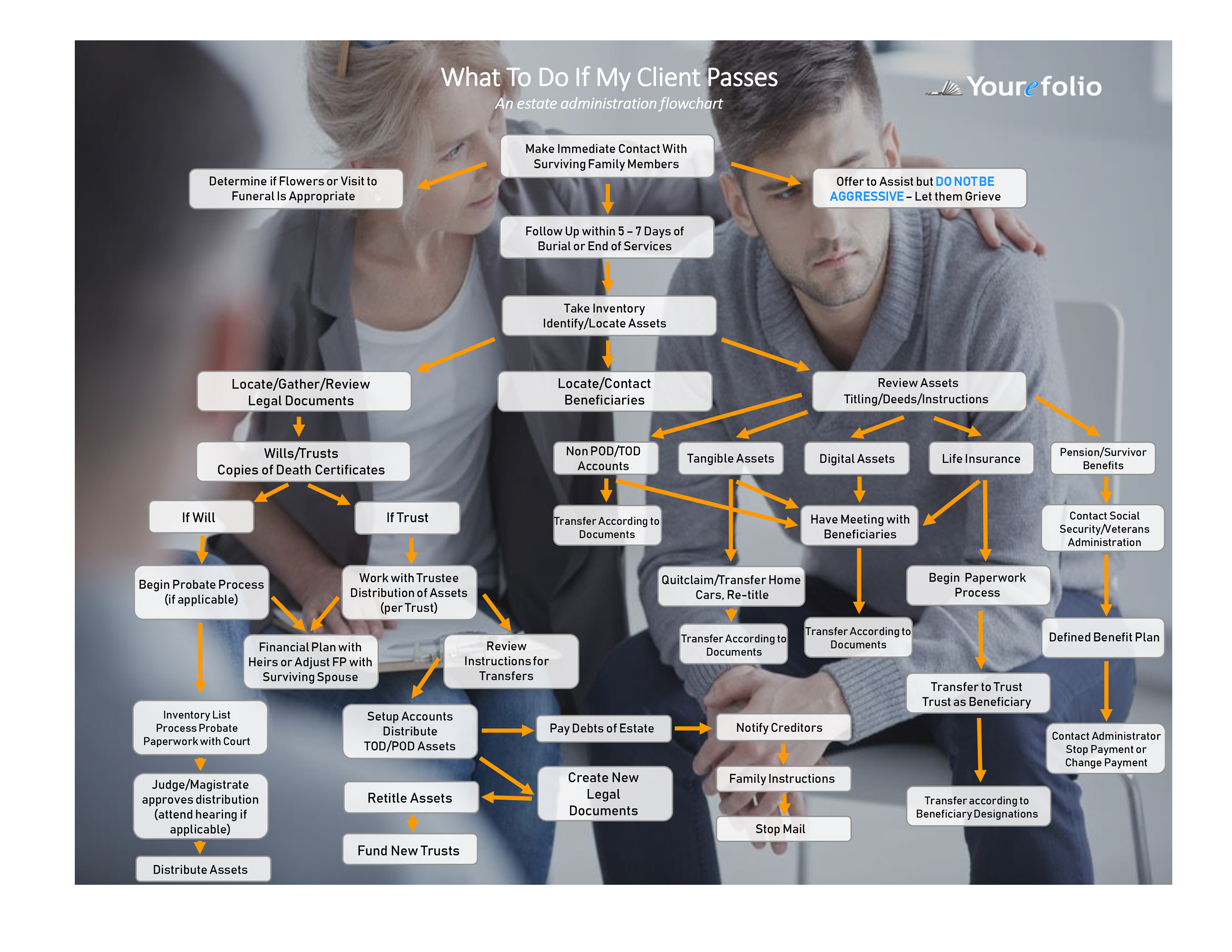

They also can help clients to complete and update their estate planning documents. In particular, they can ensure that clients' wills are complete and correct, that they have health care directives in place, and that they have named the correct beneficiaries on their IRAs and 401(k) accounts. Benson suggested contacting all clients over age 70 to make sure they have these documents in order. (The AICPA's Personal Financial Planning (PFP) Section offers a checklist of vital estate planning documents for your clients at aicpa.org.)

Advising clients on long-term-care and housing decisions

Choosing where to live in old age can be a difficult and emotionally trying decision for clients and their families. Older people are often understandably reluctant to leave their homes, even if they are struggling with everyday tasks. Senior housing—even when clients won't require skilled nursing care—can be expensive, and it comes in a bewildering variety of options, from assisted-living facilities to skilled nursing homes to continuing care communities. Hiring an in-homecaregiver comes with its own set of tax and liability implications.

CPAs can help clients assess their finances and determine which senior living or long-term-care options make the most sense. However, they can also take the extra step of becoming familiar with the senior housing facilities and options available in their community.

Jim Sullivan, CPA/PFS, a financial planner and author of The CPA's Guide to Financing Retirement Healthcare and a forthcoming guide on elder planning and life transitions after retirement, and Sarenski recommended visiting local skilled nursing and assisted-living facilities to learn about their pricing and amenities, and the level of care they offer. "They're always having open houses," Sullivan said. Also, get to know other professionals in this area, such as nursing home directors and aging life care professionals, they suggested.

Sullivan suggested encouraging clients and their families to discuss living and long-term-care options before a crisis occurs. "You can help clients think carefully about what the housing needs are, their safety concerns, and what the plan is," he said. Such a conversation can easily segue into "a discussion about what types of communities are available in your area, and that's where you use the knowledge you've gained by going to those communities."

Such knowledge can be reassuring to clients, Sullivan said. "There's comfort in knowing that you know the local community in terms of these issues."

WHERE TO LEARN MORE

CPAs already have the technical knowledge and skills necessary to add some elder planning services to their practices, Sullivan, Shenkman, Sarenski, and Benson agreed.

However, those interested in doing more for elderly clients would benefit from learning more about aging, health care, elder financial abuse, and Social Security and Medicare. The PFP Section's resources (aicpa.org/pfp/elder) are one place to start. These resources include videos, podcasts, and articles on topics such as financial and tax planning for clients with Alzheimer's disease, planning for Social Security and health care in retirement, and protecting clients from elder financial abuse. The section's resources also include Sullivan's books (mentioned above).

Having basic knowledge of trusts and estates would also be helpful, Benson and Shenkman said.

To better understand what your clients with chronic illness and their caregivers are going through, Sullivan recommended reading medical narratives: nonfiction written by people living with various medical conditions. (See his Pinterest site at pinterest.com/becca1999 for suggestions of books on aging, caregiving, and death and dying, and on conditions such as amyotrophic lateral sclerosis (ALS) and Alzheimer's.) Not-for-profit organizations serving people with specific illness, such as the Alzheimer's Association and the Parkinson's Disease Foundation, can also be good sources of information, Benson said.

Networking with professionals who assist the elderly, such as elder law attorneys and aging life care professionals, can be another good way to learn more about elder planning issues. To find them, you can reach out to the local chapter of their organizations, Benson said, or even ask family and friends. "It seems like everybody's gone through this process with a parent or a relative or someone they know," he said.

Elder care professionals can also refer prospective clients your way, Sullivan said. They don't typically meet too many accountants, he said, "but they're always interested in meeting people who might be a potential source of referrals."

The biggest challenge to implementing elder planning services, Shenkman said, might be shifting your and your clients' perspective. CPAs need to "rethink the scope of their role," he said, and "educate the client to how incredibly helpful the CPA, their trusted adviser, can be as they age" by demonstrating the value of their services.

One way to do so, he said, might be to review older clients' annual tax returns and ask them related questions about elder issues, such as if they are paying bills on time and whether they'd like help. You could also include a letter with older clients' tax returns explaining the services you could provide and how you'd bill for them, he said.

Simply advertising the new services on your website can be effective, Sarenski said, because that's how adult children of elderly parents will find you. "I've had two or three cases where people have reached out from other states, saying, 'I looked at your website. My parents live in your town, and they could use the kind of help you're offering,' " Sarenski said.

Elder planning "can be a profit center for accounting firms," Sarenski said, but, more than that, it's providing much-neededservices. "These families need the help and expertise you can bring," Sullivan said. "Accountants who can provide technical and tax advice can help people who are going through a process they probably haven't been through before. You can be very stabilizing to a family."

Or, as Shenkman put it, "I'd much rather have an elderly client or family member have a CPA looking out for them than probably anyone else I could think of."

About the author

Courtney L. Vien is a JofA senior editor. To comment on this article or to suggest an idea for another article, contact her at Courtney.Vien@aicpa-cima.com or 919-402-4125.